As Budget 2024 unfolds, it brings significant changes to the real estate sector, particularly in the realm of property transactions. Federal Finance Minister Muhammad Aurangzeb, during his budget speech in the National Assembly, unveiled a new tax regime for capital gains on property sales. This article breaks down the key aspects of these proposed taxes, providing insight into their implications for both filers and non-filers in the real estate market.

Overview of the New Real Estate Tax Structure

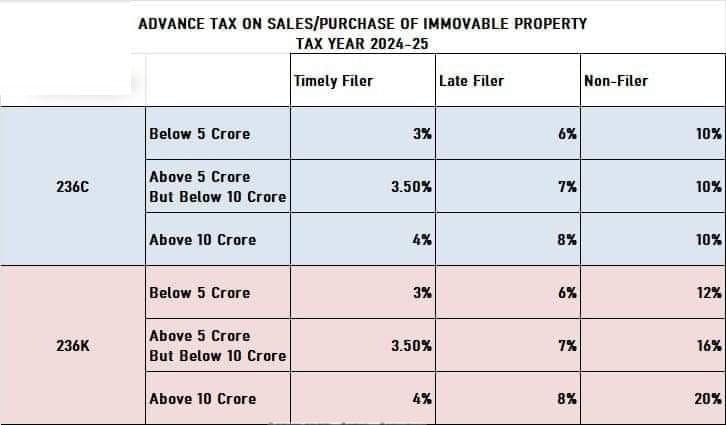

The new tax framework for real estate, effective from the next financial year, introduces a tiered system with differentiated tax rates for filers and non-filers. Here’s a detailed look at the changes:

For Filers

Filers – individuals or entities who regularly submit tax returns – will see a 15% tax rate on the purchase and sale of property. This rate aims to ensure compliance and proper documentation of real estate transactions, promoting transparency in the sector.

For Non-Filers

Non-filers, on the other hand, face a significantly steeper tax burden. The budget proposes a 45% tax rate on property transactions for non-filers. This sharp increase serves as a deterrent against remaining outside the tax net, thereby encouraging more people to comply with tax filing requirements.

Late Filers

For those who file taxes but do so late, the budget introduces a separate tax rate, aiming to further streamline and regularize the tax filing process.

Objectives Behind the Tax Changes

Finance Minister Aurangzeb highlighted several key objectives behind these tax modifications:

- Documenting the Economy: One of the primary goals is to bring more real estate transactions into the documented economy. By imposing higher taxes on non-filers and late filers, the government aims to reduce the prevalence of unreported or underreported property sales.

- Addressing Rumors: There have been various speculations and rumors within the housing sector regarding tax evasion and unregulated transactions. The new tax rates aim to dispel these rumors by establishing a clear, enforceable tax policy.

- Promoting Transparency and Accountability: The introduction of distinct tax rates for filers and non-filers is designed to promote greater transparency and accountability in real estate dealings. This move is expected to enhance the overall integrity of the market.

- Ensuring Proper Accommodation: By fostering a more structured and documented real estate market, the government aims to ensure that public accommodation needs are met more effectively. A transparent market is more likely to provide accurate pricing and better availability of housing options.

Revenue Goals and Economic Impact

The government has set an ambitious target of generating Rs 477.11 billion from income tax on properties in the upcoming fiscal year. This revenue is crucial for funding various public services and infrastructure projects.

The anticipated impact of these taxes on the real estate market is multifaceted. While there may be initial resistance from non-filers due to the higher tax rates, the long-term benefits include a more robust and transparent property market. Filers are likely to continue their activities with greater confidence, knowing that their transactions are documented and aligned with government policies.

Conclusion

The proposed taxes on real estate in Budget 2024 mark a significant shift in how property transactions will be taxed moving forward. By differentiating tax rates based on filing status, the government aims to enhance compliance, promote transparency, and achieve substantial revenue goals. For real estate investors, buyers, and sellers, understanding these changes and adapting to the new tax landscape will be essential for navigating the evolving market dynamics.

For more updates and detailed analysis on the impact of Budget 2024 on real estate and other sectors, stay tuned to our blog.

Feel free to share this article from Urban City Lahore with others who may be affected by the proposed tax changes, and leave your comments or questions below!

Join The Discussion